Income that has never been disclosed to the Israeli tax authorities – whether originating in Israel or abroad – creates fertile ground for concerns, stress, and insecurity for those who have not reported correctly, whether due to lack of awareness or neglect. Handling such situations requires a responsible approach and professional guidance.

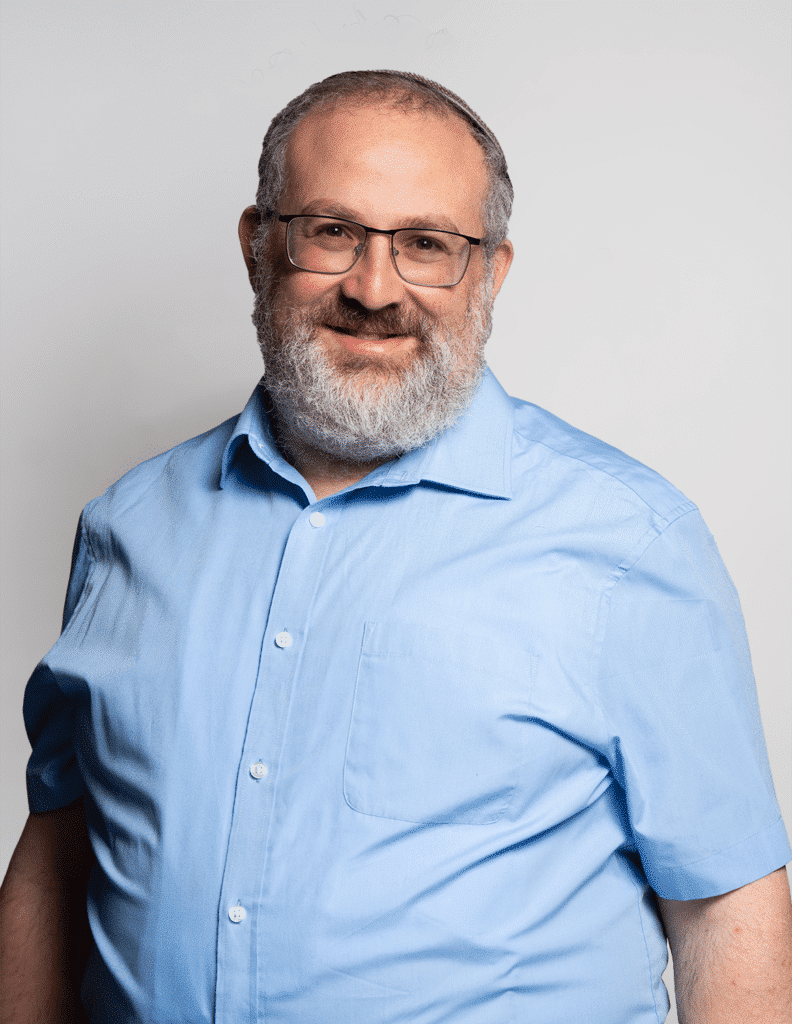

Our tax department assists clients in these situations to evaluate the full picture and begin to operate in a correct, accurate, and transparent manner with the tax authorities. Currently, there is no formal voluntary disclosure program as there was in the past, but our office knows how to operate in accordance with regulatory and legislative developments, relying on extensive experience working with the Israel Tax Authority. Our goal is to bring the client back to legal and safe conduct, with professional, discreet, and reliable guidance.

We believe that early treatment and close guidance turn a complex situation into an opportunity to build a new order.

As part of the service, we accompany clients who have faced discrepancies or non-reporting, analyze their tax situation, examine the possible regularization methods, and implement a strategy aimed at minimizing exposure and providing peace of mind, both mentally and financially.