Proper tax planning is a vital and essential step in the process of immigrating to Israel (Aliyah) or returning to the country after a prolonged period abroad. For new immigrants (Olim Hadashim), returning residents (Toshavim Chozrim), and veteran returning residents (Toshavim Chozrim Vatikim), the state grants a series of impressive tax benefits. These benefits aim to ease reintegration into the local economic system and encourage the move or return to Israel. Primarily, these benefits include a tax exemption in Israel on foreign income.

However, the full and correct realization of these benefits is not automatic. It requires advance preparation, appropriate professional guidance, and a deep understanding of the Israeli tax system alongside that of the country of origin. Any error in planning or reporting can lead to unexpected tax liabilities. Therefore, it’s crucial to consult a tax advisor or accountant specializing in residency and international taxation from the early stages of deciding to return or immigrate to Israel.

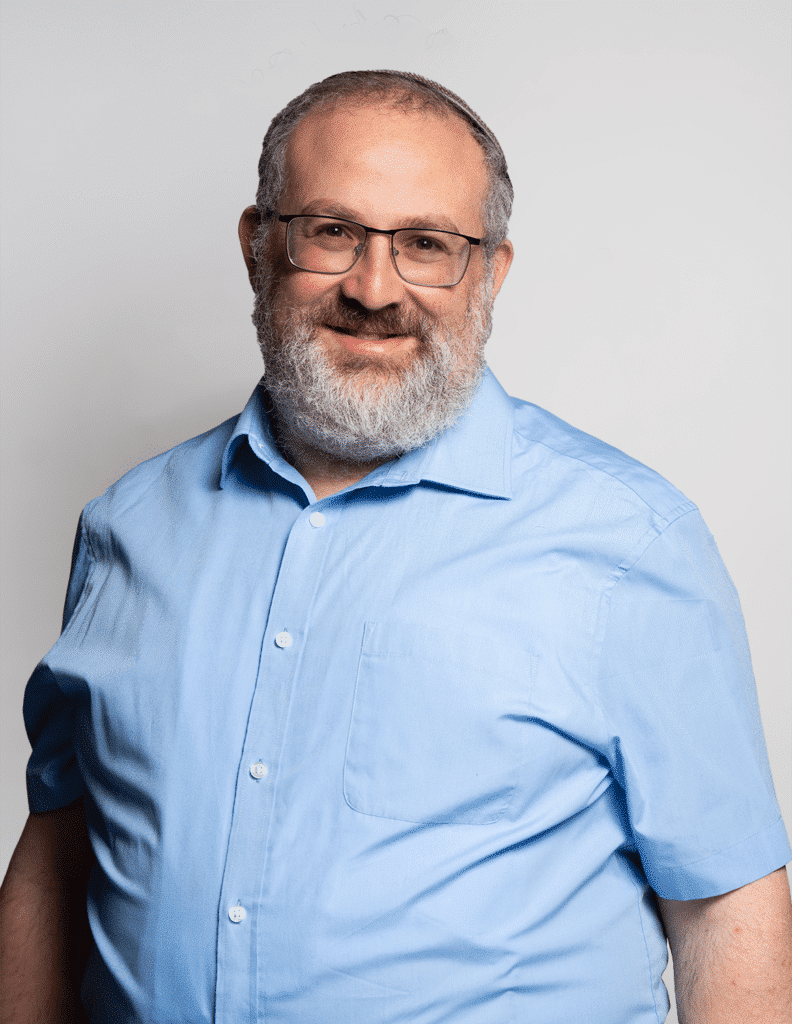

Our tax department specializes in guiding individuals before their immigration or return to Israel. We offer clients comprehensive solutions for all their financial and global activities. Our ability to provide professional attention to all relevant tax aspects for the client under one roof is a unique and significant advantage of our firm. The collaborative work of our professional teams from the Israeli Taxation Department and the International Taxation Department allows us, in real-time, to plan the optimal reporting strategy for the client, discuss and resolve complexities, and perform all necessary adjustments. In this way, we consistently succeed in minimizing the overall tax burden – both in Israel and abroad – and saving the client unnecessary or voluntary tax payments.