A Trust is a legal arrangement where a designated individual holds assets for the benefit of another person. Every trust has three key parties:

The Grantor (Trust Creator): The individual who transfers the funds or assets into the trust.

The Trustee: The individual or entity that holds and manages the assets until they are transferred to the beneficiary.

The Beneficiary: The person for whom the trust was created, who will ultimately benefit from the resources held within it.

Typically, a trust is managed according to a “trust deed” (or “trust agreement”), in which the grantor instructs the trustee on how to manage the trust, how to invest the funds or assets, and under what circumstances funds can or should be released to the beneficiaries, and so on. There is no single format for these documents, although most countries worldwide have laws regulating some of the basic rules and responsibilities.

Trusts are a popular and particularly effective way to manage intergenerational wealth and are also an excellent option for securing the financial future of individuals with functional, physical, or mental disabilities.

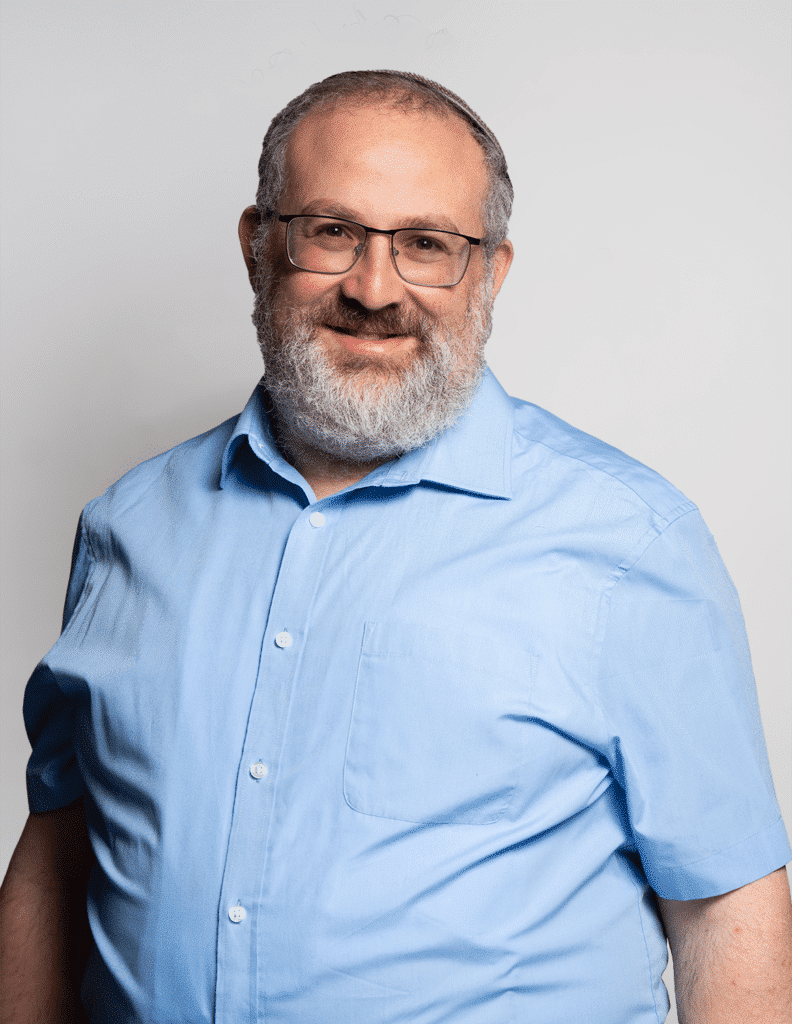

Trust taxation is a unique area of expertise in our firm. The extensive experience we’ve gained in advising and filing reports over the years demonstrates that good intentions can easily turn into potential “tax accidents”—which could effectively diminish the resources the beneficiary receives from the arrangement set up for them.

Therefore, we recommend contacting us for consultation at the very beginning of the trust’s setup and drafting process. Obtaining a professional opinion from our expert team – among the leaders in trust taxation in Israel – will help ensure the trust is structured optimally and that tax implications do not undermine its objectives.