By law, shareholders in a company are also required to file an annual personal tax report. While this might seem straightforward, it often proves to be a complex matter requiring significant expertise, especially concerning private companies, “wallet companies” (Hevrot Arnak – shell companies used to manage personal income), or intricate legal structures. The main challenge lies in perfectly aligning the individual’s report with the company’s financial statements and the tax laws governing this interface. Discrepancies or inconsistencies in reporting can trigger tax authority investigations and sometimes lead to unnecessary tax exposure.

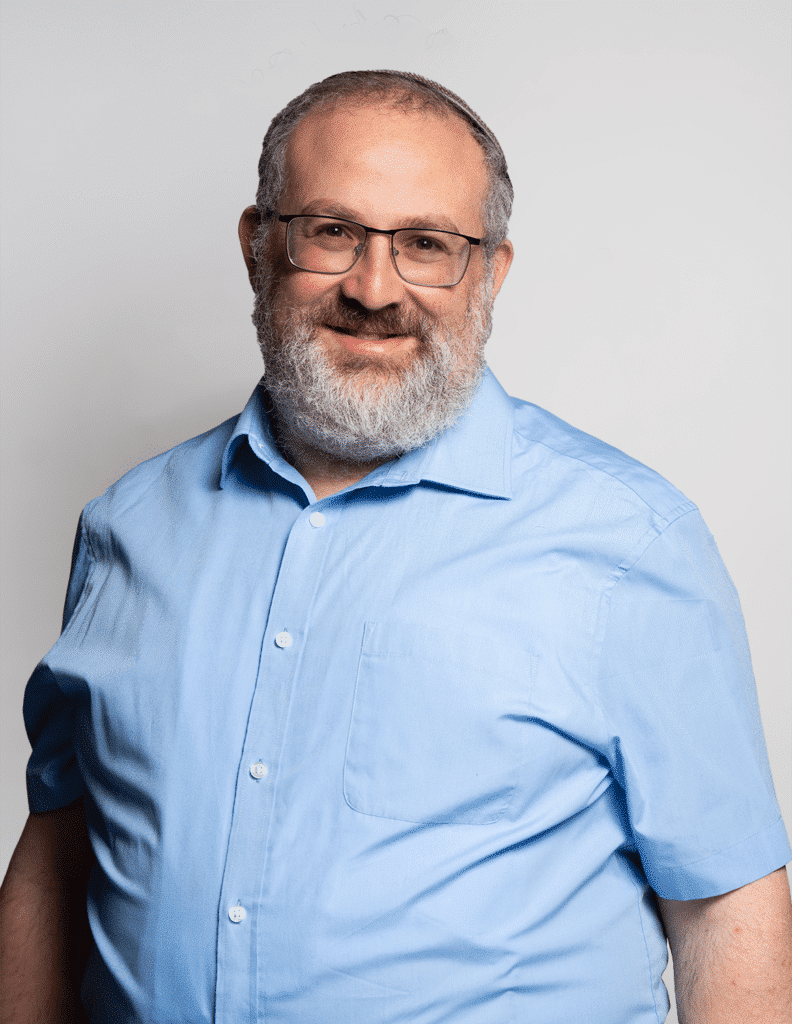

Preparing a shareholder’s personal report involves considering all aspects of their activity, both personal and related to the company they own. Our accountants provide comprehensive guidance to shareholders throughout all stages of submitting their personal reports. We work in full cooperation with our firm’s audit and accounting teams to ensure accurate and complete reporting in accordance with ongoing legislative updates and the latest guidelines from the Israel Tax Authority.

As part of our service, our professional team addresses sensitive issues such as excessive owner withdrawals, personal use of company assets, and the establishment of “wallet companies.” We analyze the potential tax implications and develop an action plan tailored to the client’s business structure and personal circumstances.