Retirement is not the end of the road – it’s a new beginning, a new chapter in life where people start enjoying lives of leisure and need the savings they’ve accumulated during their working years more than ever. For Israeli citizens who also hold foreign citizenship and have savings in a foreign country, the moment of retirement is a critical juncture from a tax perspective. It requires consideration of the tax and pension laws of both countries, as well as any existing tax treaties between them.

Due to the differing tax methods between Israel and other countries, savings accumulated over a lifetime can be significantly impacted if not planned for in advance. Tax planning for retirement prevents unpleasant surprises, preserves the value of your savings, and helps you maintain financial stability in this new chapter of your life.

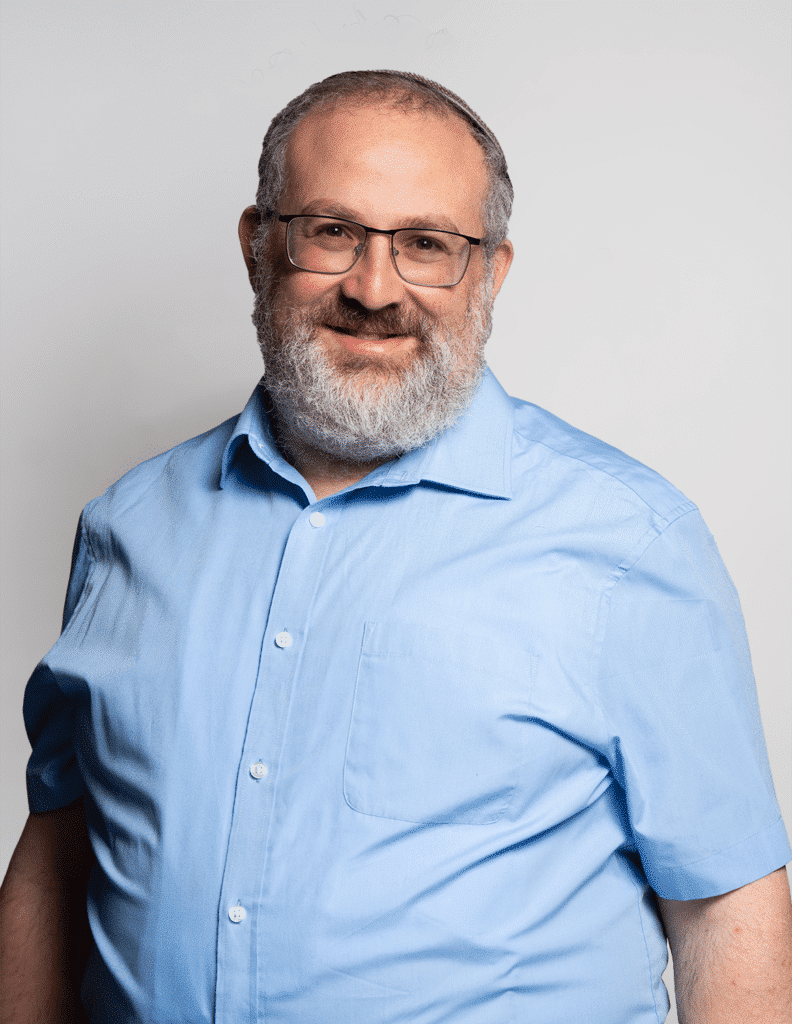

Our team of experts has in-depth knowledge of the tax implications of tax systems in Israel and other countries, including the USA, UK, and France. We provide smart and effective solutions for proper management of your retirement resources. The service includes comprehensive consultation and the construction of a personalized retirement plan that considers all financial, tax, and pension aspects – to ensure your peace of mind and financial security upon retirement. The consultation includes addressing provident funds (kupot gemel), pensions, and advanced study funds (kranot hishtalmut), as well as National Insurance benefits in Israel and other countries.

It is recommended to start the consultation process approximately three years before your retirement date. The consultation is conducted jointly with your personal pension advisor, and if necessary, also in cooperation with an expert from our international taxation department, to jointly formulate an optimal strategy for your retirement.