Considering leaving Israel and settling abroad? Before making such a crucial decision, which has significant personal and financial implications, it’s very important to consult with an expert. An expert can provide comprehensive advice and help you make an informed decision that considers all your future financial needs.

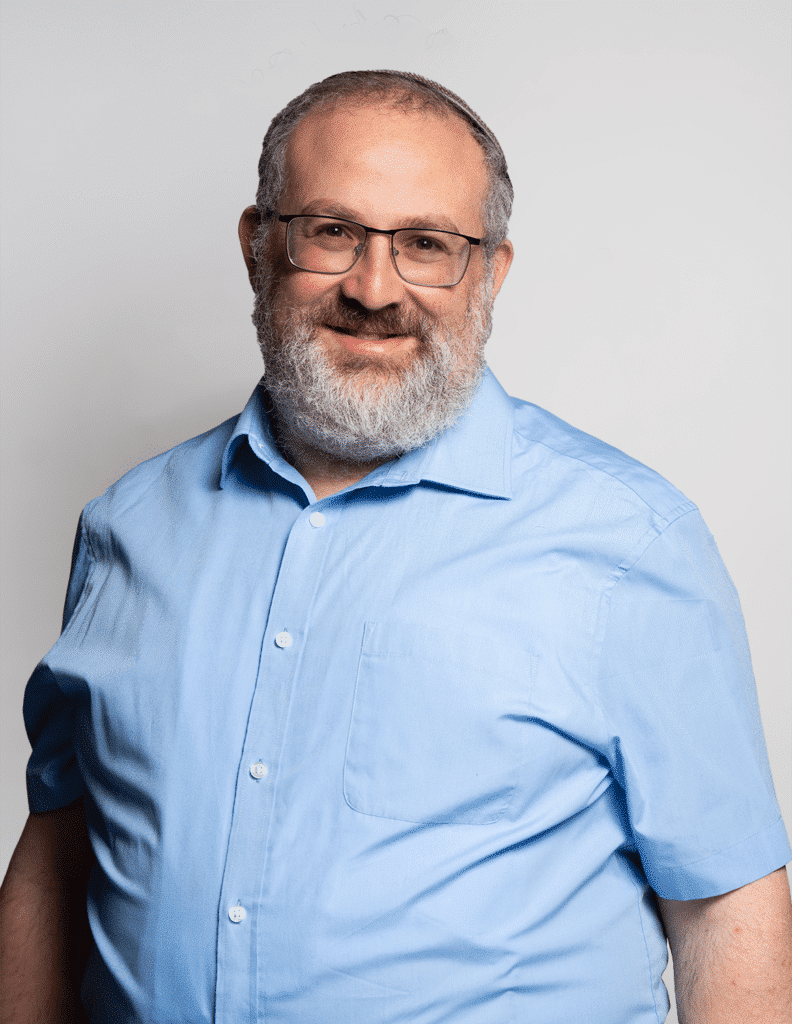

Our professional team, together with the client, analyzes the financial and tax implications of taking this action in Israel, performing precise tax calculations and risk assessments. The process of terminating residency from Israel requires proving that your center of life has moved outside of Israel, submitting a residency termination declaration form (Form 1348) to the Income Tax Authority, and providing adapted reports to the National Insurance Institute. Handling this process correctly can prevent double taxation, reduce future exposures, and provide peace of mind and legal clarity with the authorities.

Our professional team can provide comprehensive support – from initial consultation, preparing and submitting tax reports, to submitting the termination position to the Tax Authority, even in borderline situations that are not unequivocally defined by law.