A Capital Declaration is a crucial tool used by Israeli tax authorities to monitor the financial activities of business owners over time. Its purpose is to ensure complete and regular reporting and to prevent cases of unreported income. If you receive a request to submit a Capital Declaration, it’s vital to treat it seriously. This is a fundamental process in your financial dealings with the authorities, so seeking professional assistance is highly recommended to ensure accuracy and proper submission.

Often, the first Capital Declaration is required when opening a self-employed business file with the tax authorities. This initial report is particularly significant as it serves as the baseline for comparing your future business activities.

Subsequent requests for Capital Declarations are typically sent every four to seven years to identify and address any unexplained discrepancies or errors. Engaging professionals in this submission process can help you avoid in-depth audits, tax assessments, and unnecessary inquiries from the tax authorities.

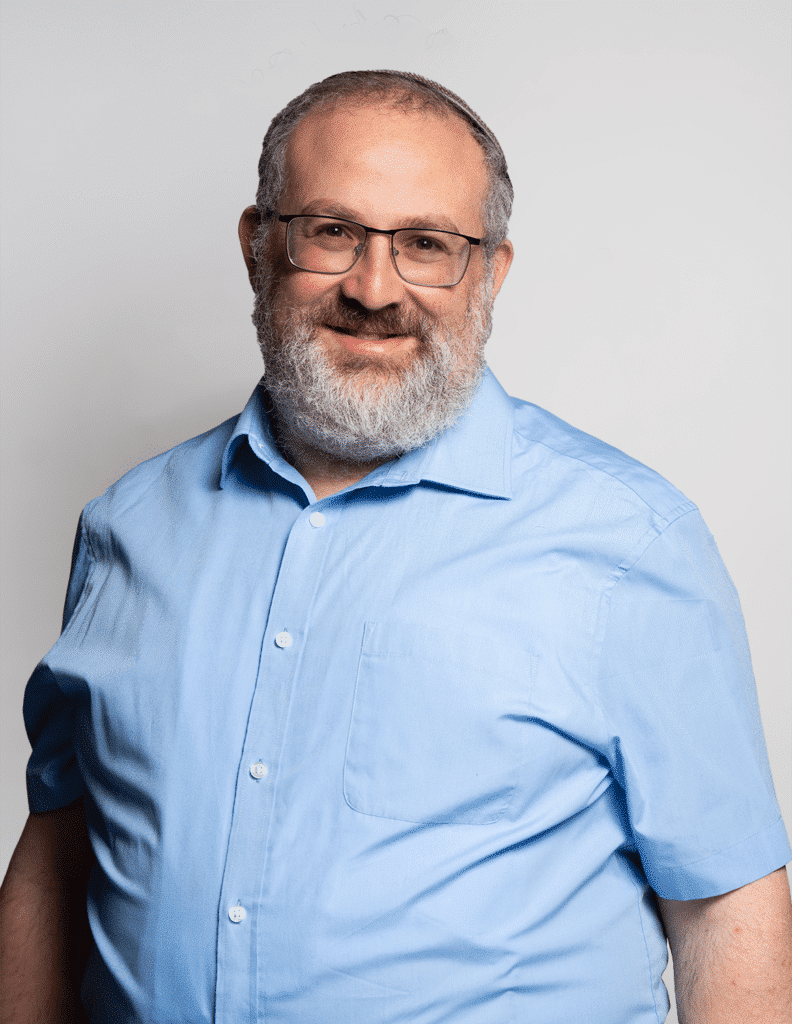

Our tax department offers comprehensive support for Capital Declarations, from initial submission to periodic reviews of recurring statements. This service includes a comparative analysis of reports over the years, identifying discrepancies, correcting inconsistencies when needed, and minimizing unnecessary risks with the Tax Authority. Our professional team also specializes in addressing passive and active income from abroad, as required.

Our primary goal is to ensure accurate, well-founded, and correct reporting that protects you opposite the tax authorities, prevents unnecessary exposure, and provides you with peace of mind in your financial dealings.