What Israel’s New Self-Employed Pension Plan Requirement Means for Freelancers

As part of the 2017-18 Budget, the government required that, as of the 2017 tax year, those who are self-employed are required to pay into an Israeli-recognized pension plan.

The amounts required by law are as follows (for 2017):

| Monthly profit (NIS) | Yearly profit (NIS) | Percentage contribution required | Max. required monthly contribution (NIS) | Max. required yearly contribution (NIS) |

| On portion from NIS 0 – 4,836 | On portion from NIS 0 – 58,038 | 4.45% | 215 | 2,583 |

| On portion from NIS 4,836 – 9,673 | On portion from NIS 58,038 – 116,076 | 12.55% | 607 | 7,284 |

| On portion above NIS 9,673 | On portion above NIS 116,076 | 0% | 0 | 0 |

For example:

- A freelancer whose annual profit is NIS 45,000 must contribute at least NIS 2,003 into a pension plan (45,000 X 4.45%)

- A freelancer whose annual profit is NIS 90,000 must contribute at least NIS 6,594 into a pension plan (58,038 X 4.45% + 31,962 X 12.55%)

- A freelancer whose annual profit is NIS 116,076 or above must contribute at least NIS 9,866 into a pension plan (58,038 X 4.45% + 58,038 X 12.55%)

Note: Freelancers can contribute more than the required amounts.

A freelancer who is also an employee of a company and receives benefits, can deduct the sum of contributions by themselves and their employer from their salary from the above amounts.

For example, if a freelancer owes NIS 6,500 total, and NIS 4,500 has been paid in from their payroll deductions, their remaining contribution is NIS 2,000. Contributions are due by December 31, 2017.

Who is exempt

- Anyone born in 1961 or earlier (i.e. aged 55+ when the law came into effect)

- Anyone aged 60 or over at the end of the tax year

- Anyone aged 21 or under at the end of the tax year

- Anyone who opened their VAT file within six months of the end of the tax year

What happens if I don’t contribute?

The tax authority will calculate the required contribution after you file your tax return. A letter will be sent out if the contributions made were too little, and further non-compliance will lead to a NIS 500 fine.

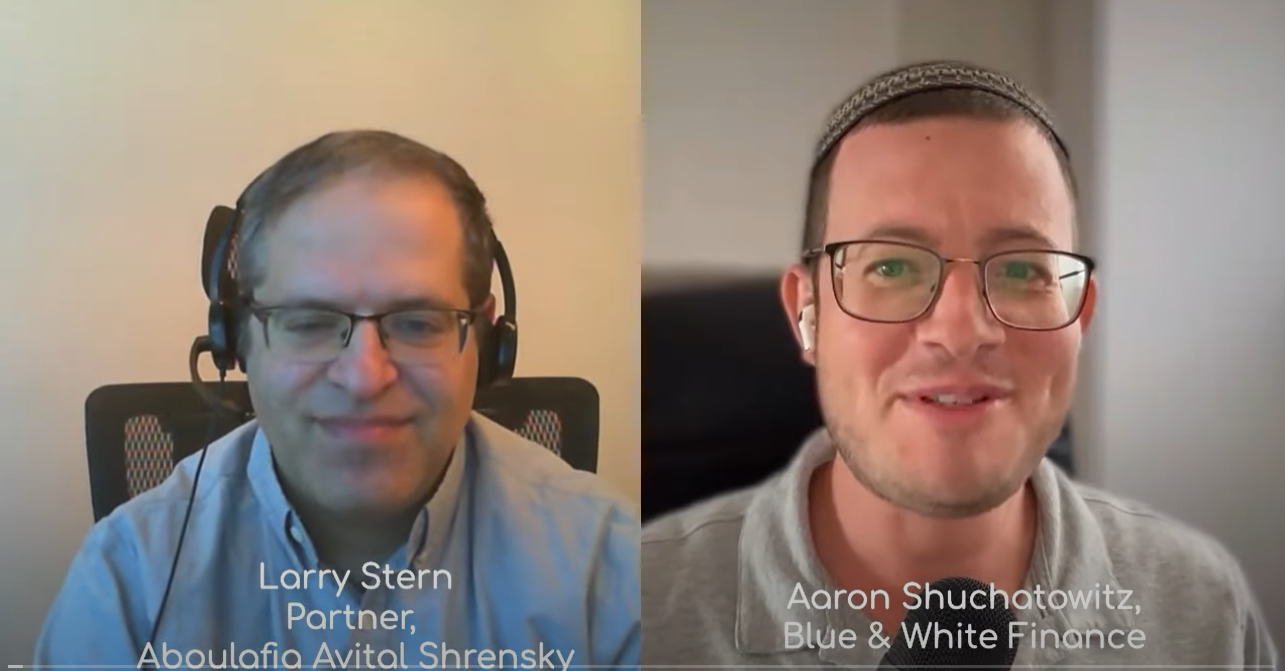

For more information or assistance with self-employment issues, contact us.