Happy Sukkot

Wishing you a Happy Sukkot holiday, with a prayer for "Sukkot Shalom" for all! For the benefit of anyone who missed our webinars, they have been uploaded to the YouTube channel- You are invited to watch and feel free to share Tax-Efficient Investing: Managing Your U.S. Inheritance from Israel - Webinar Ron Zalben our US partner CPA and Doug Douglas Goldstein Key Financial Planning Issues for Olim - Webinar Larry Stern, U.S CPA hosted by Nardis Advisors

ON THE HOUSE- The israel real estate podcast

The complex financial and tax aspects of purchasing, owning, selling, and inheriting real estate in Israel as a U.S. citizen

Should US citizens living in Israel renounce their US citizenship?

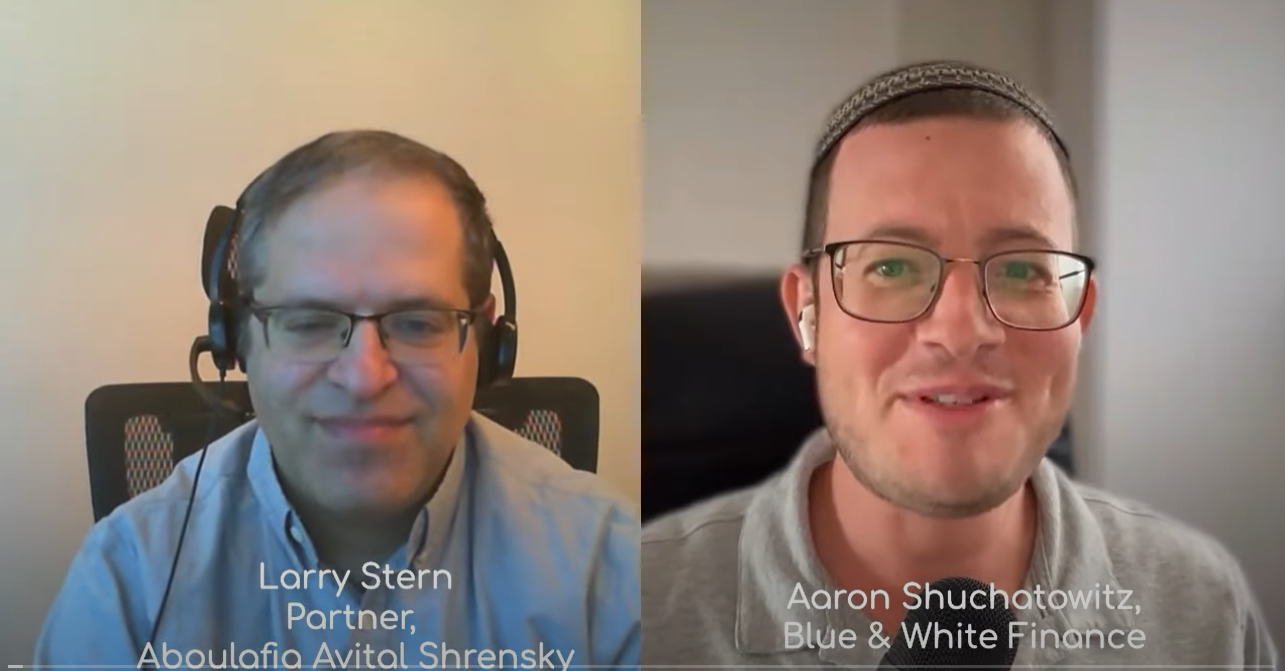

we invite you to enter a fascinating conversation between CPA Larry Stern, a partner and member of our U.S taxation department, and Aharon Shuchatowitz, from Blue & White Finance. The topic discussed: Should US citizens living in Israel renounce their US citizenship?

Thoughts onto paper – Yom Ha’atzmaut 76 Binyamin Radomsky CPA | Partner Israeli tax dept

I’m not a big writer. Certainly not of personal feelings. Yes, i cried when each of my children was born, and when they reached various milestones, but in general, my feelings are kept inside. Three times in the past though i have felt the need to put down some thoughts into words. The first was when a young mother, whom i had the pleasure of knowing (as the sister of a good friend from University days) passed away at the age of 27 after a very sudden illness, leaving behind a husband and three young children. The second time was

“Kamha Dapascha” and Shares

The Israel Tax Authority issued an important ruling regarding the donation of shares that benefits donors and Israeli charities. The Tax Authority ruled that when shares are donated, donors will get a tax credit for the fair market value of the shares donated and will avoid paying capital gains tax on the transfer of shares by the donor. Previously, the tax authority required donors to realize the unrealized gains on the donations as capital gain subject to 25% taxation. The donor will be entitled to claim a tax credit of up to 35% of the value of the donation on

Israel invoice – all you need to know

As of 05/05/24, the "Israel Invoice" model will come into effect. According to the new model, the Tax Authority will issue allocation numbers for tax invoices issued to customers who are authorized dealers, through an online system. These allocation numbers will be required as a condition for deducting input tax in transactions above the ceiling set by law, which as of 2024 stands at NIS 25,000 (before VAT) and in accordance with the outline listed in the law. In order to operate the new model, preliminary settings of the system are needed Stage 1 First, someone in the business must be registered as

GENERAL BUSINESS GRANTS COMPENSATION

Presentation in English by Binyamin Radomsky, CPA -partner at Aboulafia accountants firm. View now and find out everything there is to know

Itzik Libster, Partner Israeli Tax Department

Partner since 2014 Specializations: Israeli taxation, Land Appreciation Tax, retirement planning How did it all start? Looking back it's funny to see how as a young man I ended up in the accounting profession that I now love so much. I come from an ultra-Orthodox and scholarly background, until the age of 20 I studied in a yeshiva every day, at a certain point I decided to enlist in the army and from there the road to Bar Ilan University was challenging but safe. I remember the deliberations of what profession to study and the great joy I felt when I discovered

Haya Weissfish, Partner Bookkeeping Department

Partner since 2014 38 years experience Tell us a little about how you got into your field of work? I've loved numbers as far back as I can remember, math problems were an amusement for me in my childhood. Unlike today, there weren't all the sophisticated computer games that keep today's children occupied, and that meant we had to keep ourselves occupied. My favorite past-time was numbers and naturally I continued with this love in my professional life as well. My first job was with the firm's founder, the late CPA Shlomo Aboulafia, who taught me the secrets of the accounting profession,

For the full interview Larry Stern, CPA (USA) Partner – US tax dept

Partner since 2015 Specializations: US and international taxation You were born and raised in the USA - how did you decide to make Aliya? I have always known that I would like to live and raise my children in Israel. My wife and I decided at a very early stage in our life together that we would make the move to Israel. And despite the high level of motivation we shared, doing it with two small children aged three and five was no simple undertaking - the responsibility was enormous! And like all new immigrants, we were also faced with numerous pressures: