Who Needs to File a 2016 Israeli Tax Return?

Israeli tax law states that every Israeli resident or household is required to file a tax return every year in a timely way, whether or not taxes are due. The current deadline for filing your 2016 tax return is May 31, 2017 (it may be extended by a month); a late filing may result in hefty monthly penalties.

But a supplement to the law grants exemptions from filing if you meet certain criteria; the exemptions are mostly focused on people who will not have to pay additional taxes.

Special Circumstances and Who Must File

There are, however, households which will be required to file Israeli tax returns, regardless of earnings. If you fall into at least one of the following categories, you must file a return:

- You are a controlling shareholder (10%+ ownership, including holdings of close family) of a company or similar corporation. This applies to all Israeli corporations, as well as many overseas corporations.

- Earned income of spouses are assessed together, rather than as separate calculations. See here for more.

- You received severance pay that was spread over two or more years, including 2016 (known as פריסת פיצויים).

- You were required to file a tax return for 2015, but not for one of the aforementioned reasons.

- You own shares in a non-publically traded non-Israeli corporation.

- The value of your overseas assets at any point in 2016 exceeded NIS 1,850,000. This requirement is not relevant for those who fall into the “10-year exemption” for new olim.

-

Anyone who is a beneficiary of a trust (irrespective of whether distributions are received), if:

- S/he is 25 years old or older

- The value of the trust assets exceeds NIS 500,000

- S/he is aware of being a beneficiary (it may be fairly difficult to prove otherwise)

- See here for the definition of a beneficiary of a trust

- Residency in Israel is based on a “center of life” test, but may also be subject to the number of days one has spent in Israel over the tax year. Anyone meeting the day test but still claiming non-residency must file a tax return in Israel – explaining why they are not considered resident, as well as giving a report of their non-Israeli income that is arguably exempt from Israeli taxation.

- Anyone who has, over a 12-month period, transferred a sum of NIS 500,000 or more out of Israel. Seemingly, this includes transfers to a personal account abroad. The logic would seem to be that perhaps the Israeli is purchasing an asset abroad, and must therefore report any subsequent income. The rules say that a tax return is also required in the tax year following the transfer.

Exemptions to Tax Filing Requirements

So, assuming you do not meet any of the criteria above, you are exempt from filing a 2016 tax return if your income in 2016 was exclusively from the following list:

- Salary (including pension and פיצויים) – if the gross amounts received were less than NIS 641,000 (per spouse) and tax was deducted at source.

- Rental income), if the total gross rents were less than NIS 333,000 and the 10% tax was paid by January 31, 2017.

- Foreign interest, dividends, capital gains, etc., if the total gross income was less than NIS 333,000 and the tax (the rates depend on the exact nature of the income) was paid using the “short form” at the post office or online by April 30, 2017.

- Foreign pension, provided that the total gross income was less than NIS 333,000 and no tax is due in Israel under the provisions of section 9c of the tax law (see here for more).

- Israeli-sourced interest and/or linkage income, provided that either it is exempt from Israeli tax or tax was deduced at source and the gross income was less than NIS 636,000.

- Capital gains made on the sale of publically listed shares, provided that either they are exempt from Israeli tax or tax was deduced at source and the gross sales were less than NIS 1,850,000.

- Other types of income which are subject to tax, where the tax has been deducted at the maximum rate.

- Other income that is exempt from Israeli taxes.

- Your total taxable income from all sources was less than NIS 803,520.

If the total gross income of (7) and (8) combined is over NIS 333,000, no exemption is granted.

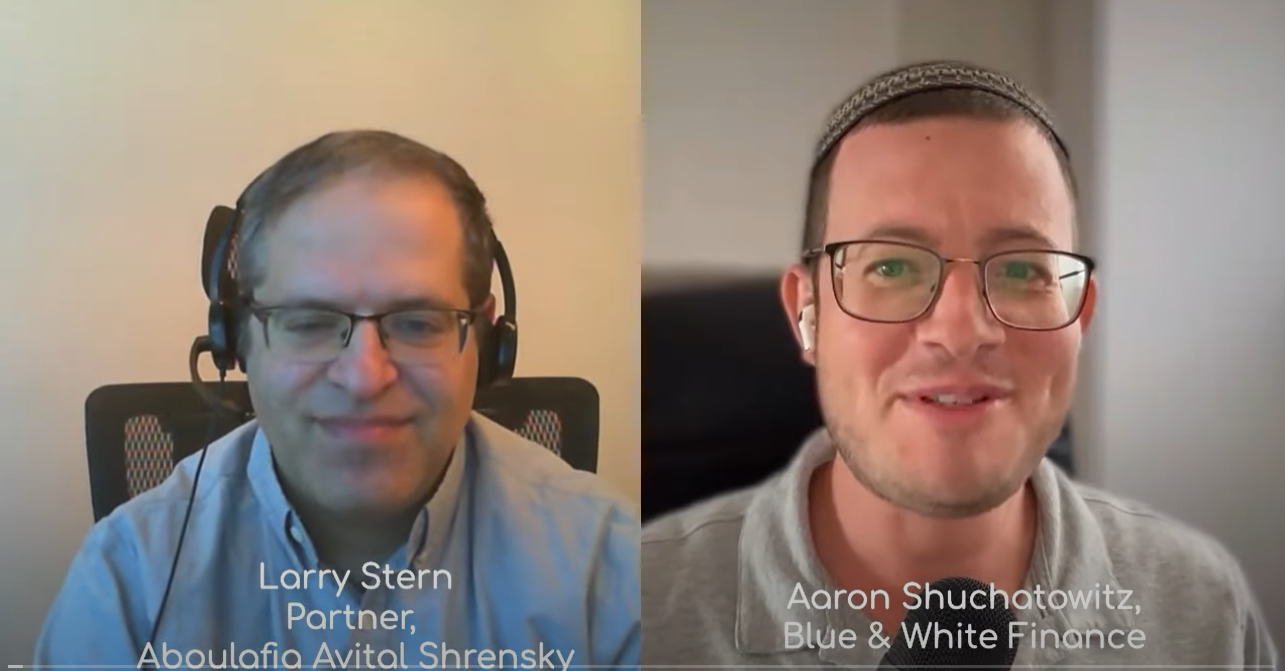

While it is not difficult to figure out the parameters of Israeli tax filing requirements, please contact us for professional guidance.