עליה ומיסים | Aliya and Taxes

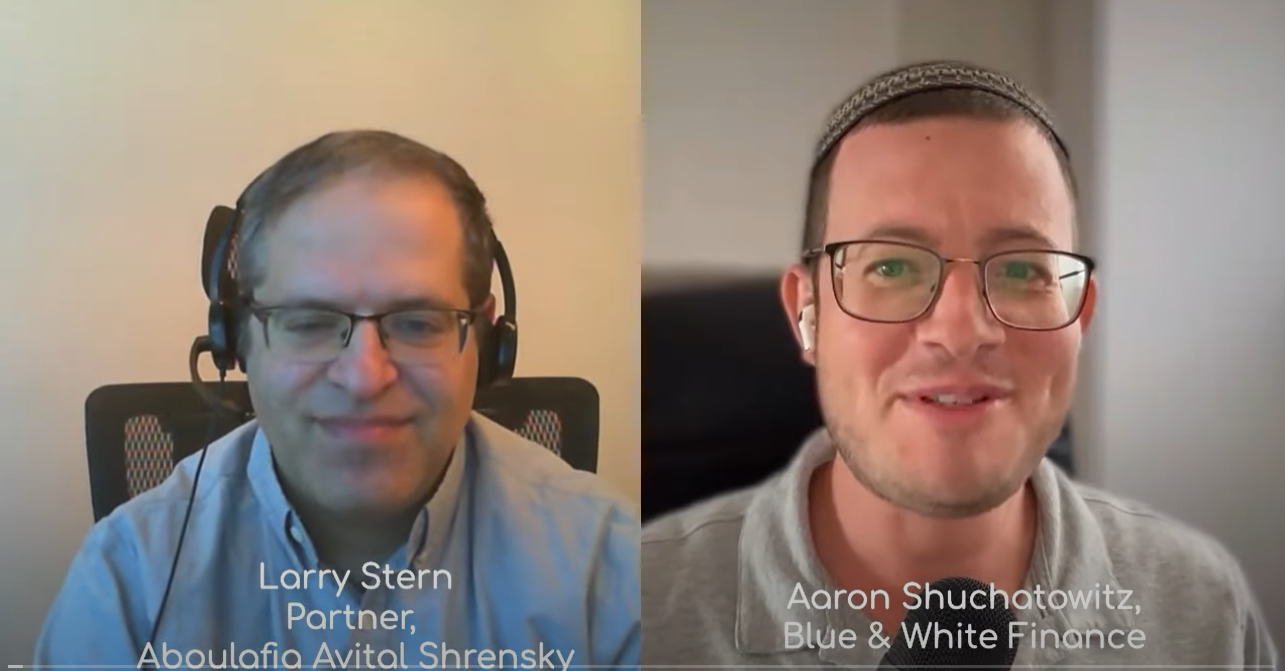

Larry Stern, CPA (US)

Here’s the scenario. You have just made Aliya and you are trying to get yourself settled. The last thing you want to think about are taxes. However…I am now living in Israel and I want to be compliant with my new country’s tax rules. I know what I was required to do “back home.” What do I need to do in my new home?

Under Israeli law, all Israeli residents or households are required to file an annual income tax return. However, as with every rule, there are exceptions. Exemptions are granted to certain groups of taxpayers, usually when there is expected to be no tax due. In addition, a special income tax exemption from reporting and taxation exists for olim/first-time residents/long-term returning residents for the first 10 years on income earned outside of Israel (including passive investment income as well as employment income where the work was performed while physically outside of Israel). Different rules may apply to Bituach Leumi (Israeli social security).

The following is a partial list of those people required to file an annual Israeli income tax return, regardless of the level of income:

- A controlling shareholder (10%+ ownership, including holdings of close family) of a company or similar corporation. This applies to all Israeli corporations, as well as many overseas corporations.

- You have a “small business” in Israel – either as an Osek Patur or Osek Murshe.

- Certain trust beneficiaries (regardless of whether distributions are received).

- Anyone with reportable (passive or active) income from outside Israel on which no Israeli tax has been paid (e.g. foreign salary but the work performed in Israel).

In addition to the obligations in Israel, you may also have obligations to file tax returns in your home country. Each country is different, but U.S. citizens and permanent residents are required to file annual tax returns even after moving outside the United States (state tax returns can vary by state). Many other countries require a tax return only for the year of relocation or if you continue to maintain assets in your previous country of residence.

Tax obligations can be complicated and therefore it is advisable to speak to a professional to ensure you are meeting your worldwide tax obligations in Israel. Our CPAs would be happy to assist in analyzing your circumstances to see what filing requirements you may have in Israel and/or in your previous country of residence. You can contact us at info@aboulafia.co.il or visit our website at www.aboulafia.co.il for